HST Update Utility

Executive's HST Product Update Utility has been updated to also update taxes on Special Orders. The Customer Tax Exemption report has also been updated to include HST Exemptions.

Contents

Outline

These instructions assume that you have already ran the previous update utility to change your Products from GST to HST, so the Product Apply button is not functional in this version. If you have not updated your Products yet, please contact us for the Product Update Utility Version 1.

|

| For stores with multiple locations, the Special Order update component of the utility must be run on each store's database separately. |

Download and Run the Utility

Download the utility: [File:HSTTaxSetup4.exe]

- Click Save, and save it to your C:\Executive folder (or C:\Program Files\Executive folder if C:\Executive does not exist).

- When the download is complete, double click the HSTTaxSetup4.exe file.

- Press Install to extract and run the utility.

Linking Data

You must link the utility to the ExecutiveData.mdb file (Multi-Stores link to the individual ExecutiveData.mdb files one at a time to perform updates on each). The linking process will be quicker if nobody is currently using Executive.

Finding Your ExecutiveData.mdb File Path

- Open Executive and navigate to Maintenance-System-Link Data.

- Find the filepath on the right side ending with ExecutiveData.mdb (likely similar to X:\ExecutiveData.mdb)

- Select this path, then right click and copy the text.

- Close Executive and return to the Update Utility.

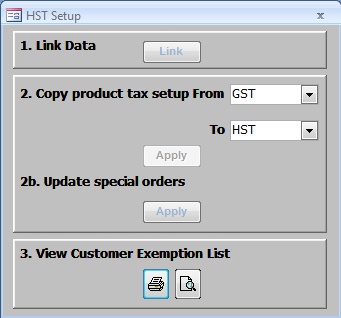

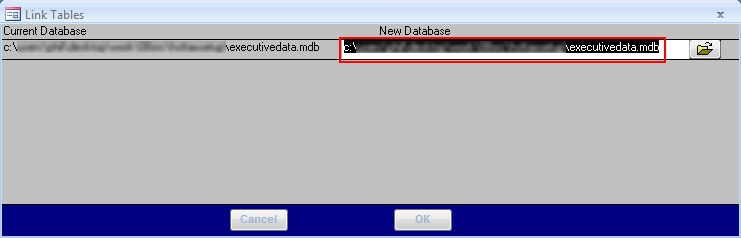

Click on the Link button to bring up the file linking window.

Remove the current C:\Executive\ExecutiveData.mdb path, and right click and paste in the new path. Click OK to link the data.

|

| If you are unable to link the data, double check that the path is correct and matches the ExecutiveData.mdb path in Executive. |

Updating Special Orders

The utility has been updated to change the taxes on existing special orders, as transferring old special orders to a sale may cause the old tax rates to be used.

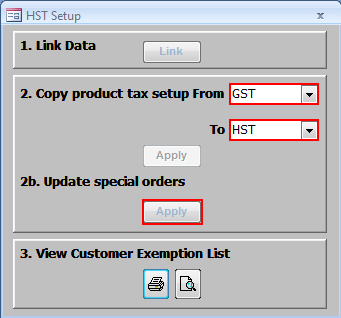

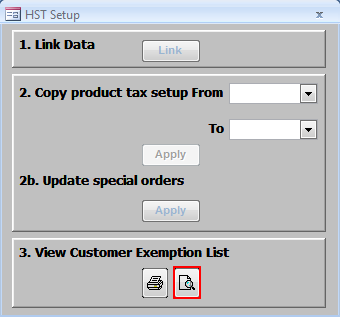

Using the drop down boxes, choose to Copy product tax setup from GST to HST. To perform the update, hit Apply on 2b.Update Special Orders

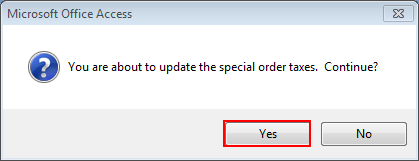

A confirmation box will pop up, outlining what is about to be modified. Click Yes to continue.

The update process is generally very quick, so it may take as little as a few seconds. When the update is finished running, a confirmation box will pop up notifying you that it is Complete. Click OK to return to the utility.

Customer Tax Exemptions Report

Since there may be existing PST or HST tax exemptions for customers, a report is available to display these in list form. This list can be used when adding Customer HST Exemptions (where applicable).

|

| Exemption rules may have changed, so some PST/GST exempt customers may not be exempt from HST. Consult your accountant or a tax authority for more details on HST Exemptions. |

Choose the preview button to view the Customer Exemption report. (Alternatively, choose the print button to print a copy of the report without previewing it.)

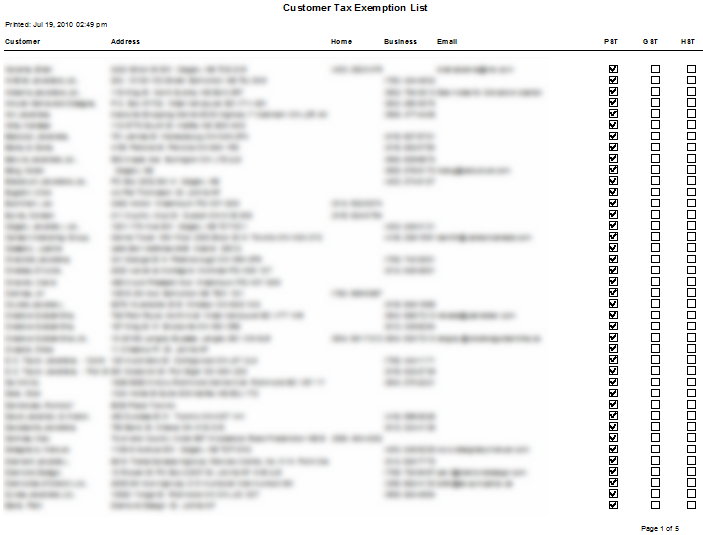

The report displays the name and contact information of customers, along with their current tax exemptions.

|

| Be sure that no customers have pre-existing HST Exemptions, as imported customer lists may have been marked Tax 3 Exempt in the past. |

To create an HST Exemption in Executive, the HST tax must be active.

- To set up general exemption groups, go to Maintenance-System-Tax Setup-Tax Exempt Status.

- To set up a specific customer exemption you can go to the customer's profile, select the Tax/Interest tab, and set up the new exemption (with Exemption ID if necessary).

Exiting the Utility

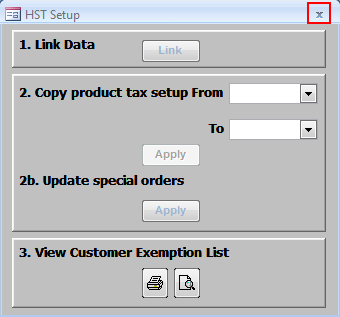

When you are finished with the Product Update and Customer Exemptions, press the X button to exit the utility.